On February 1, China bids farewell to the Year of the Ox and rings in the Year of the Tiger. The ox symbolizes prosperity, diligence, and perseverance. In 2021, this symbol was apt, as Chinese economic policy shifted from “growth at all costs” to “common prosperity” and the country diligently persevered through many regulatory changes. Chinese equities were collateral damage in the process. As the Year of the Tiger rolls in, Chinese equities could remain volatile but purr stronger.

Slowdown in China

As the world’s second-largest economy, China has grown at an average rate of nearly 9 percent per year since the turn of the century, with the exception of 2020. It was one of the first major economies to exceed its pre-pandemic size. In the last year, China’s growth has started to show signs of slowing as it faces three major pressures: 1) muted consumer spending and supply disruptions as the country remains on a zero Covid-19 policy, 2) stifling regulations leading to weakening economic expectations, and 3) a structural slowdown in the property sector. Tighter monetary conditions from policymakers trying to rein in financial risks have also contributed to slowing growth.

Shifting Fiscal and Monetary Policy

As the economy slowed in the fourth quarter of last year, top officials and the People’s Bank of China emphasized the goal of economic stability in 2022. A shift in their stance became evident, from tightening to normalization and then toward the easing needed to meet a GDP growth target estimated at 5 percent for 2022. Fiscal stimulus is likely to be directed toward infrastructure spending and tax cuts. The People’s Bank of China will execute on its role by maintaining ample interbank liquidity and encouraging credit growth. While most global central banks are tightening monetary policy, the Chinese central bank is bucking the trend. The recent reduction in several benchmark interest rates is evidence of ongoing monetary easing.

Measured Support from the People’s Bank

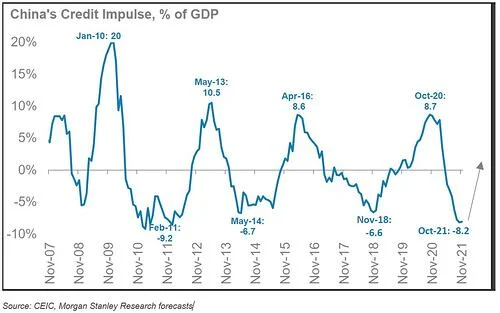

In the past cycles, as seen in the chart below, credit growth in China has preceded economic growth, with spillover effects on the rest of the world. Current policy support may accelerate the credit cycle in China and put a floor on the slowing economy. Nonetheless, both monetary and fiscal policy measures will likely be more measured as the government has shifted its focus from the quantity of growth to quality of growth. This focus means that the ripple effects of a reaccelerating China on the global economy will be modest.

Winds Changing Direction

Although China’s central bank is signaling easing monetary conditions, it is yet to be seen if the commercial banks will bite the bullet and accelerate lending. With the overhang from real estate developers, the credit quality environment in China has yet to show signs of improvement. Unless that happens, banks may remain hesitant to increase lending. State-owned banks may need to carry a greater burden of supporting the economy and may drive lending activity in other financial institutions.

For investors, monetary and fiscal stimulus needs to trickle into the real economy through traditional channels for a material shift in the investment case for Chinese assets. Policy plays an overarching role in the Chinese economy, so a shift in policy tone is a sign of the winds changing direction. There could be more policy support forthcoming, and any resulting rebound in real economic activity could benefit investors. Chinese equities took it in the chin last year with all the pressures on corporate profits from slowing growth and tightening policy. As headwinds turn to tailwinds in the Year of the Tiger, it could result in stronger returns for equity investors.

Originally published on CommonWealth.com